A new way to build credit

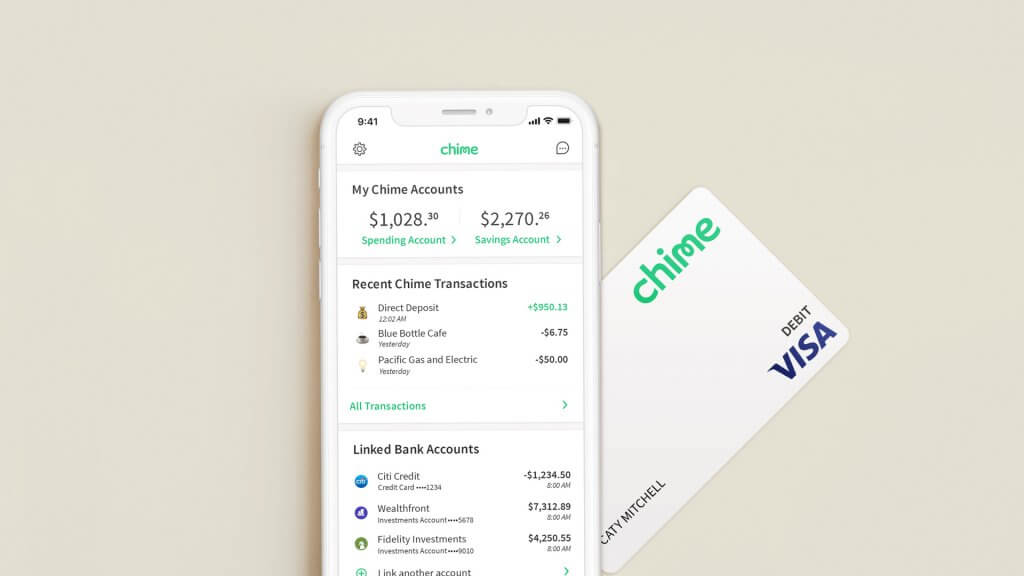

With the early direct deposit feature, your direct deposit will be posted to your Chime Spending Account as soon as it is received from your employer or payer. If you have questions about the timing of your.

Increase your credit score by an average of 30 points² with our new secured credit card

No annual fee or interest

No credit check to apply

No minimum security deposit required³

- Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. And may be used everywhere Visa debit cards are accepted.

- Depositing checks through Chime can be done on your mobile device. With no lines, no forms, and no additional fees, mobile check deposit is a great way to avoid having to ever go to a physical bank for your deposit needs. Using Chime Mobile Check Deposit, you can deposit up to $2,000 per check, up to 10 check deposits.

- The qualifying direct deposit must have been made by your employer, payroll provider, or benefits payer by Automated Clearing House (ACH) deposit. Bank ACH transfers, Pay Friends transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits.

No fees or surprises

We’re here to help you break free from fees, annual interest, and large security deposits

No credit check to apply

Everyone deserves a fair shot at good credit, so we don’t check your score when you apply

Make every purchase count

Whether it’s gas or groceries, now everyday purchases can count toward building credit

Safer credit building

Turn on Safer Credit Building and your balance will be automatically paid on time, every month. We’ll keep the major credit bureaus updated.⁴

Join more than 1.5 million members already using Credit Builder

Available for Chime Spending Account holders with eligible direct deposit¹

Apply NowAlready a Chime member? Learn how to sign up for Credit Builder

See what our members are saying

“This card has changed my credit score for the good and I love it”

'My fiancé and I wants to buy a house...It(Credit Builder) is slowly but surely moving me and my family closer to our dreams.'

'I'm new to credit so it feels really good seeing that I'm safely increasing my score.'

Questions?

Here’s everything you need to know about our Credit Builder

Before Applying

All you need is a Chime Spending Account and direct deposits of $200 or more within the past 365 days.

Don’t have a Chime Spending Account? Apply for one in under two minutes!

No way! We think everyone deserves a chance to build credit, so we don’t check your credit score when you apply.

Do I need to have a Chime Spending Account to use Credit Builder?

Yes. We designed Credit Builder to work with the Chime Spending Account so that you can move money instantly—across your Chime accounts!

Does Chime charge any fees for using Credit Builder?

Nope! We do not charge fees; no annual fees, maintenance fees, international fees, and no interest.

Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build on-time payment history, increase the length of your credit history over time, and more. We report to the major credit bureaus – TransUnion®, Experian®, and Equifax®.

Learn more about crediting building with Credit Builder.

What makes Credit Builder different from traditional credit cards?

Unlike traditional credit cards, Credit Builder helps you build credit with no fees and no interest. There’s also no credit check to apply!

Credit Builder is a secured credit card. The money you move into Credit Builder’s secured account is the amount you can spend on the card. Unlike other secured credit cards, that money can be used to pay off your monthly balances. Since Credit Builder doesn’t have a pre-set limit, spending up to the amount you added won’t contribute to a high-utilization record on your credit history.

Learn more about how Credit Builder works.

Yes, Credit Builder is a secured credit card. The money you move to the Credit Builder secured account is how much you can spend with the card. This amount is often referred to by other secured credit cards as the security deposit. Like other secured credit cards, Credit Builder also reports to the major credit bureaus, to help you build credit history over time.

However, for most secured credit cards, security deposits are unavailable to you, the consumer, until you close the account. With Credit Builder, you can use your deposit to pay for monthly charges. Plus, Credit Builder charges no fees and no interest, and no minimum security deposit required!

Yes, Credit Builder reports to the 3 major credit bureaus—TransUnion®, Experian® and Equifax®

Credit Builder doesn’t have a pre-set credit limit. Instead, the money you move into your Credit Builder secured account sets your spending limit on the card.

With traditional credit cards, using a high percentage of your available credit limit could negatively impact your credit score. You don’t have to worry about that with Credit Builder because Chime does not report credit utilization.

How much you can spend with Credit Builder is shown to you as Available to Spend in the Chime app.

If I use all the money I add into Credit Builder, will Credit Builder report high utilization and hurt my credit score?

Nope. Credit Builder doesn’t report percent utilization to the major credit bureaus because it has no pre-set credit limit. That means spending up to the amount you added will not show a high-utilization card on your credit history. So rest assured to use Credit Builder for your everyday purchases and let them count towards credit building!

New member basics

How long does it take for my Credit Builder card to arrive?

After you enroll, it’ll take on average 5-7 business days for your Credit Builder card to arrive.

It’s easy! Just go to the Chime app > Settings > Credit Builder > Activate Card.

You can use the Credit Builder card anywhere Visa® credit cards are accepted.

It is an account that holds the money you’ve moved to Credit Builder. This money determines the amount you can spend with your Credit Builder card (a.k.a credit limit). You get to set your own limit by moving any amount to and from your Credit Builder secured account whenever you want.

When you make a purchase, a hold is placed on that money you just spent in your secured account. You can use this money later, to pay your monthly balance. Your Available to Spend will also go down. This way, you know how much more you can spend with your Credit Builder card.

Your Available to Spend is the money you’ve moved to your Credit Builder secured account minus the amount you’ve charged on your Credit Builder card. Move money from your Chime Spending Account into Credit Builder to increase Available to Spend any time!

Can I move money into my Credit Builder secured account from another bank?

No, you cannot move money from other banks to your Credit Builder secured account. You can only do that from your Chime Spending Account.

How long does it take to move money between my Credit Builder secured account and Spending Account?

Moving money between Chime Spending Account and Credit Buildertakes ~60 seconds! Once the transfer is complete, your transaction history will reflect the change and your Available to Spend will update.

Safer Credit Building is a feature that allows you to automatically pay your monthly balance with the money in your Credit Builder secured account. Turn it on, so your monthly balances are always paid on time! Learn more about how it works here.

Move My Pay is an optional Credit Builder feature that allows you to automatically move a set amount from your Spending Account to Credit Builder whenever you get paid. You can always make changes or move money between your Chime accounts at any time.

You can pay off your Credit Builder charges in 3 ways:

- Our recommendation is to turn on Safer Credit Building. When you make a purchase, the money you spent is put on hold in your secured account. Safer Credit Building uses that money to automatically pay your monthly balance. This will help you avoid late payments and outstanding balances.

- If Safer Credit Building is not turned on, Manual Payments can still be made at any time by going to Settings → Safer Credit Building → Make a Payment.

- ACH Payments can be made from any bank by using Credit Builder’s account and routing numbers. To find them, go to Settings → Safer Credit Building → Make a Payment → Paying with another bank

Credit Builder statements are available by the 28th of each month and due on the 23rd of the following month.

If you miss a payment, we’ll disable your Credit Builder card and ask you to pay your overdue balance. See “How and when do I pay off the card?” on how to make a payment.

If your balance due isn’t paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.

Where can I find more information on Credit Builder policies?

For the Credit Builder Visa Credit Card Agreement, please visit: https://www.chime.com/chime-credit-builder-visa-credit-card-agreement/

For the Credit Builder Application Disclosure and Secured Account Agreement, please visit: https://www.chime.com/chime-credit-builder-application-disclosure-and-secured-account-agreement

Are you familiar with mobile check deposits?

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Chime Mobile Deposits

Are you using a mobile banking app for check deposit yet?

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

Chime Mobile Deposit Stimulus Check

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!